Why won't my team do what I ask?

As a manager of people, part of your role will be to find solutions to work problems then ask your team to carry out your instructions. But isn’t it frustrating when your team repeatedly don’t follow your instructions as expected, or worse, simply ignore you?

When Branta’s working in the field, we often receive the complaint from managers that everything would be much better if employees simply did what they were asked. After cash flow, it’s the biggest cause of stress in a manager’s life since they tell their team what to do over and over until they’re blue in the face.

Common self-diagnoses include things like:

- “I didn’t anticipate this when I interviewed them";

- “They’re grown-ups, but I have to constantly remind them what to do like children”; and

- “They’re paid good money and should know what to do”

If this feels like a familiar complaint, keep reading to understand what might be going on in the relationship with your team and find out ways to fix what’s broken.

Why are my instructions being ignored?

A simple way to approach this problem is to flip it upside-down. Instead, ask yourself: “Why should my team do what I tell them to do?”. In most professional situations you shouldn’t need to tell your team what to do as most employees will be able to achieve the task in their own unique way. The only essential thing you need to agree with your team-mate is why your company needs to complete the task.

Of course there are occasional situations when your leadership needs to be functional, clear and obeyed. For example, if a fire breaks out you must immediately stop what you are doing, leave the building safely and muster in the car park. None of this is open to creative interpretation.

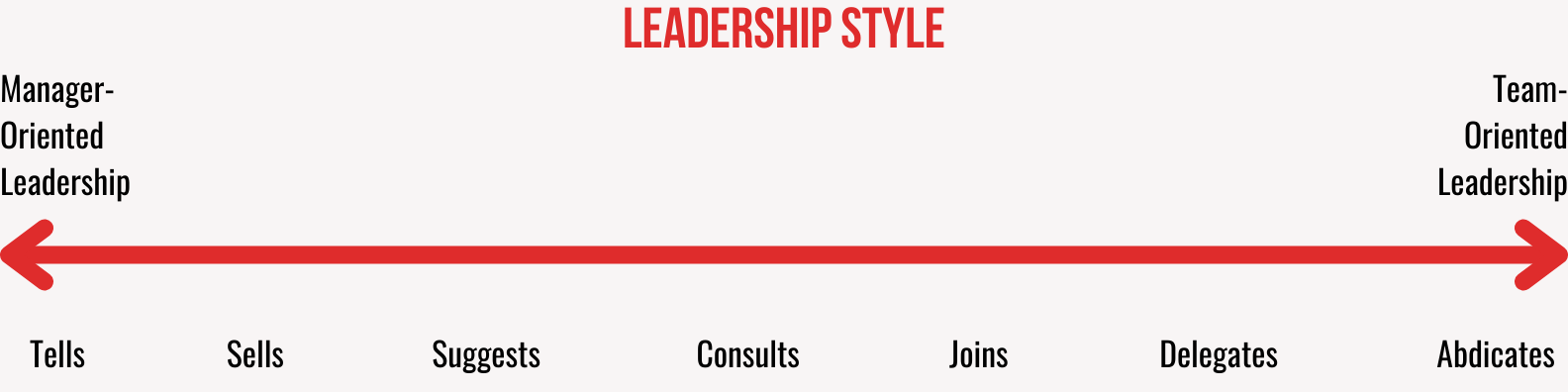

But these situations are rare and most of the time your team doesn’t need (or want) to be told what to do. The Leadership Continuum can give you some guidance on when to be autocratic and when to be relationship-led. There are always different times to lead, times to coach, and times to tell. The skill is choosing the correct style.

Each time you give one of your team responsibility for a task, you need to realise that every individual will approach its completion in a totally unique way. It will be uncommon that an employee will not know or can’t work out how to get the job done. So don’t sweat the instructions. But it is essential that you communicate with each other to understand the importance of getting that job done.

You should be clear with what needs to happen…

You need to be clear why it needs to happen…

But how it gets done should be left to the individual to find their own way.

You must give your team the opportunity to be creative.

If you give your instructions army-style, like a regimental set of orders, it’s likely that most employees will react by thinking: “Duh! I can work that out for myself! Do you think I’m stupid?”

Then worse, if you tell an employee how to carry out a task and its completion goes wrong, you’ll risk ending up with blame. And of course, this can be really destructive. If you tell an employee how to carry out a task, you’re reducing their creativity and responsibility for the situation to the point where they may stop caring about the project.

Let’s take an example

You work in a courier company and your specialism is getting deliveries to their destination on time. One day a customer comes to you with an important job: to get a donor heart from Southampton to Birmingham as quickly as possible as it’s needed for an emergency transplant operation.

As the manager allocating the jobs, it’s your responsibility to make sure the donor heart is delivered on time. You identify a free driver and give them the task of getting the heart to Birmingham.

You explain that it’s for a time-critical operation in a hospital where the patient’s life will be threatened if it’s not delivered promptly. You check your team-mate has understood the seriousness of why the urgency’s needed and let them go on their way. Thankfully the heart gets delivered on time and the operation is a success.

Unfortunaltey your driver got a puncture on the outskirts of Birmingham. But because your team-mate understood the seriousness of the job, they used their initiative to heil a ride and completed the last part of the journey in a taxi. They didn’t call you to seek permission to expense a taxi, they just did it because they realised the patient’s life was hanging in the balance.

Now let’s look at the same example, but where the instruction is given by a different leader. This manager simply told the driver to get the package to Birmingham as quickly as possible. They didn’t explain that it was a donor heart, nor that it was needed for a life-saving operation.

The manager also thought that they were being helpful by insisting that the fastest route was up the motorway system. The driver reluctantly followed this instruction and ran out of fuel on the way because the gaps between petrol stations were too great. They lost time by waiting for a breakdown service.

The driver knew that the quicker route with more petrol stations was via the cross-country route, but they used the motorways because the manager insisted on it. The heart was delayed and unfortunately the patient became critically ill as a result.

When the manager called the employee to explain the result of not delivering the heart on time, blame was instantly attached to the other party by both manager and employee. Thus eroding trust for the future and a likelihood that they think twice about following instructions.

Because the employee was able to attach blame to something (the lack of petrol), it dictated whether the heart was delivered on time or not. If the manager had explained why the delivery was so important, then all reasons for sustaining a delay would have been pushed to one side.

Why should you take notice if your team is ignoring your instructions?

If your team is seemingly ignoring your instructions, this will be having a wider negative impact on your business:

· You will erode employee trust and engagement levels;

· Business performance will be hampered; and

· You will be creating increased negative stress levels for all involved.

So how do I ensure my team is doing what I'm asking?

When you’re worried if you’re team are ignoring you, check these three basic things that you need to get consistently right: clarity, culture and interdependence.

1. Clarity – Does your team understand why they are being asked to carry out a task? What will be the result if carried out successfully? What are the implications of getting it wrong? Are they understood too?

2. Culture – Do you have the foundations of a business where independence is promoted? Are decisions criticised? Does blame get readily attributed? Do you reward regularly?

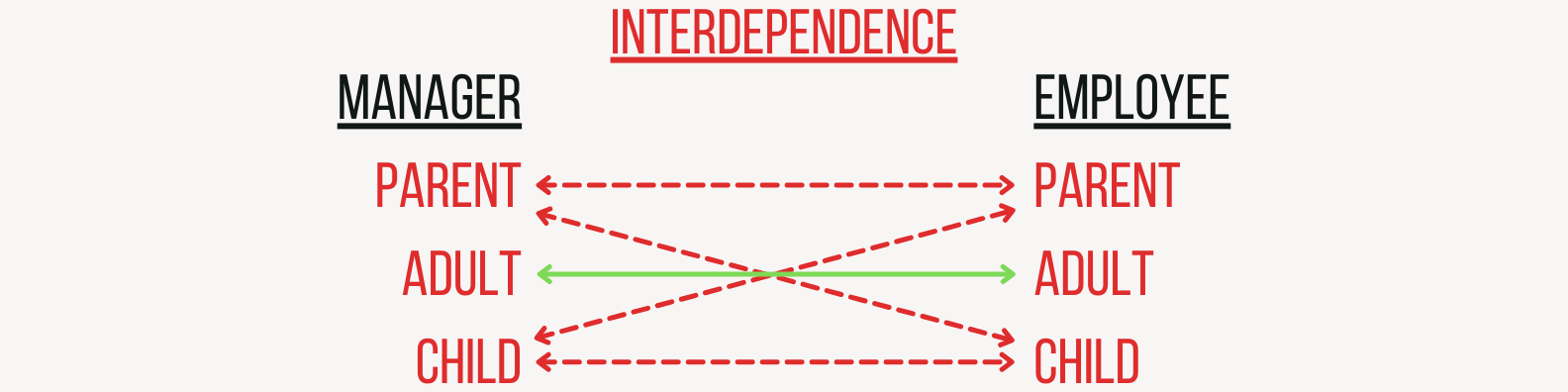

3. Interdependence – Do managers treat employees as adults? Do they behave in an adult fashion themselves? Or does either party adopt a parent or child-like role?

Whilst you’re slowly working on improving these company qualities, make sure every decision you make covers these three points with your team: understanding, motivation, responsibility.

1. Understanding – Do your instructions clearly communicate why you are asking your team-mate to perform a task? Have you checked their understanding?

2. Motivation – Will your team-mate have the opportunity to feel good about carrying out the task? Will they get a chance to show-off? Will they be proud of its completion? Is it a job they have enjoyed doing successfully before?

3. Responsibility – Does your team-mate feel that they are able to undertake the task?

If you quickly undertake these three checks for every decision you make, you’ll find that engagement should improve.

If you feel like you would like to improve your team engagement through great leadership, tell us more about your leadership style in our

questionnaire or feel free to schedule some time in our diary for a free discussion

here.