Financial Systems

Use simplicity to Drive your business

Driving a car with no dashboard would be pretty silly. You'd never know if you were breaking the speed limit, about to run out of fuel or overheat the engine. Your business is no different. If you're running things with information that's slow to arrive, possibly wrong, or not relevant to your goals then you're going to have an accident at some point. If your business is drowning in spreadsheets or paperwork, it really doesn't have to be like that in today's world.

You need a financial system where information is quick to arrive, where it's been handled and manipulated as little as possible, and where it tells you what you need to know in real-time.

We can take all of your old systems and processes and help you migrate them to business-serenity. A business intelligence dashboard that just works and tells you what you need to know about your company so you can plan intelligently for the future.

which Financial Systems challenges are you facing?

speed

Financial systems are slow to produce meaningful outputs and are holding back company velocity.

accuracy

Errors are causing poor decision-making, stress and a lack of faith in company information.

Utilisation

Is your financial information being put to good use in your company? Or is it just filed away with other compulsory stuff?

Flexibility

Are you putting off improving your system because it's too rigid? When will the cost of doing nothing exceed making a change?

complexity

Do you know how to begin a project to improve your financial systems? Or are you anxious about where to start?

How can we help?

insights

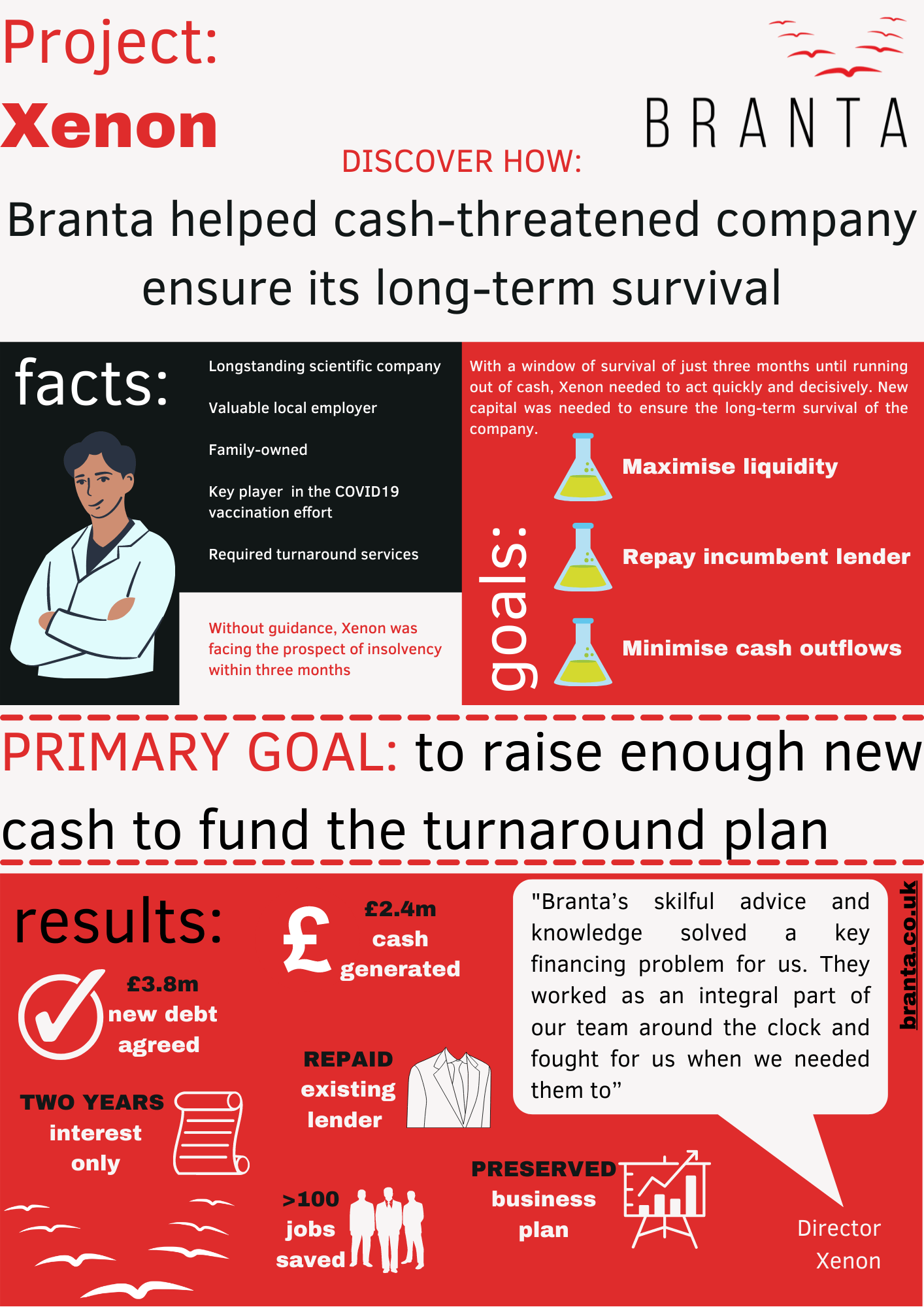

client success stories

List of services

-

Peter Green Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

-

Project Byron Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special or a unique service that you offer.

List Item 3

Who will you be working with?

-

Simon Murrells Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

-

Chris Ray Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special or a unique service that you offer.

List Item 2

Let's talk

We're excited to work with ambitious leaders who want to continue taking positive steps in their businesses to constantly move things forward. If this is you, let's talk.

free consultation

Want to chat it through first? Get some time to talk in our diary here

web chat

Prefer to type?

No problem!

Use the web chat on all our pages whenever we're available.

Branta's Other consulting services

List of services

-

Sales Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special or a unique service that you offer.

List Item 1 -

Debtor Management Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

-

Leadership Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special or a unique service that you offer.

List Item 3 -

Buying or Selling a Business Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special or a unique service that you offer.

List Item 4 -

Raising Capital Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

-

Turnaround Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.