Cash-threatened company ensures its long-term survival [infographic]

Project xenon supported by Branta

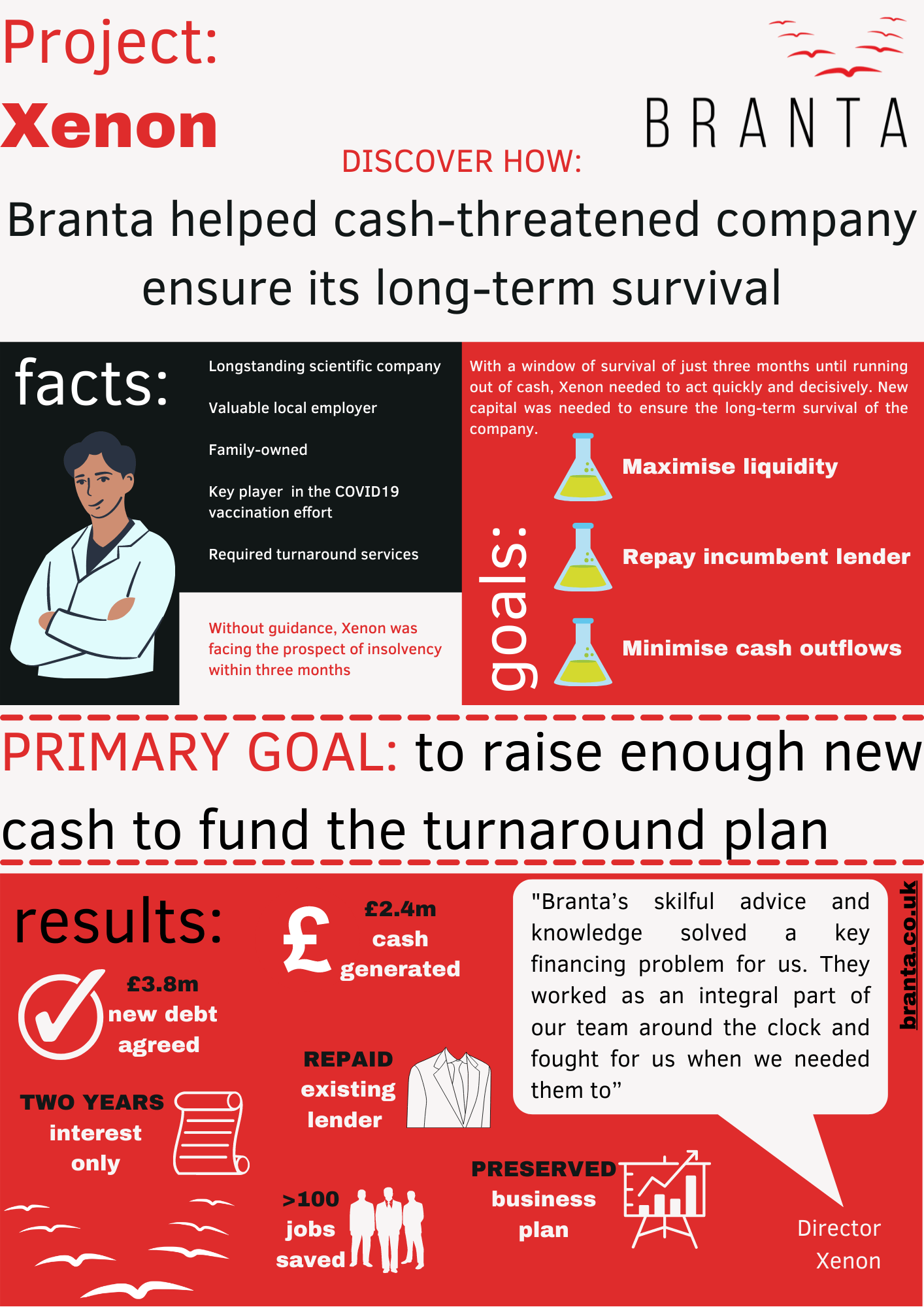

When Xenon approached Branta, things were looking really tough for them. Despite operating in a strong sector, the company had suffered a sustained period of underperformance and trading losses were rapidly consuming cash. When we first met, we estimated that Xenon would only have 3-4 months of trading left before becoming insolvent. After setting to work, Branta was able to find £3.8m of new cash to give the company more breathing space to execute its turnaround plan. If you're a SME company director or business owner who's concerned about the future of your business, you might find these facts resonate with you.

Xenon came to Branta feeling exceptionally anxious about their future. We were able to calmly analyse the situation, provide options, then execute our plan quickly and skilfully. If you're worried about the future of your business, don't suffer on your own; there are always options. But act sooner rather than later. For a free, no-obligation call with one of our friendly team, click below to get some time in our diary...