The Construction Pressure Cooker is Building

There’s a paradox in the construction sector that’s really concerning us right now. Two basic things that couldn’t co-exist in a pre-COVID world. And it’s scary to predict how things will play out. So, what’s going on?

- We’re seeing significant losses and problems being reported by the biggest construction companies at the top of the supply chain;

but at the same time…

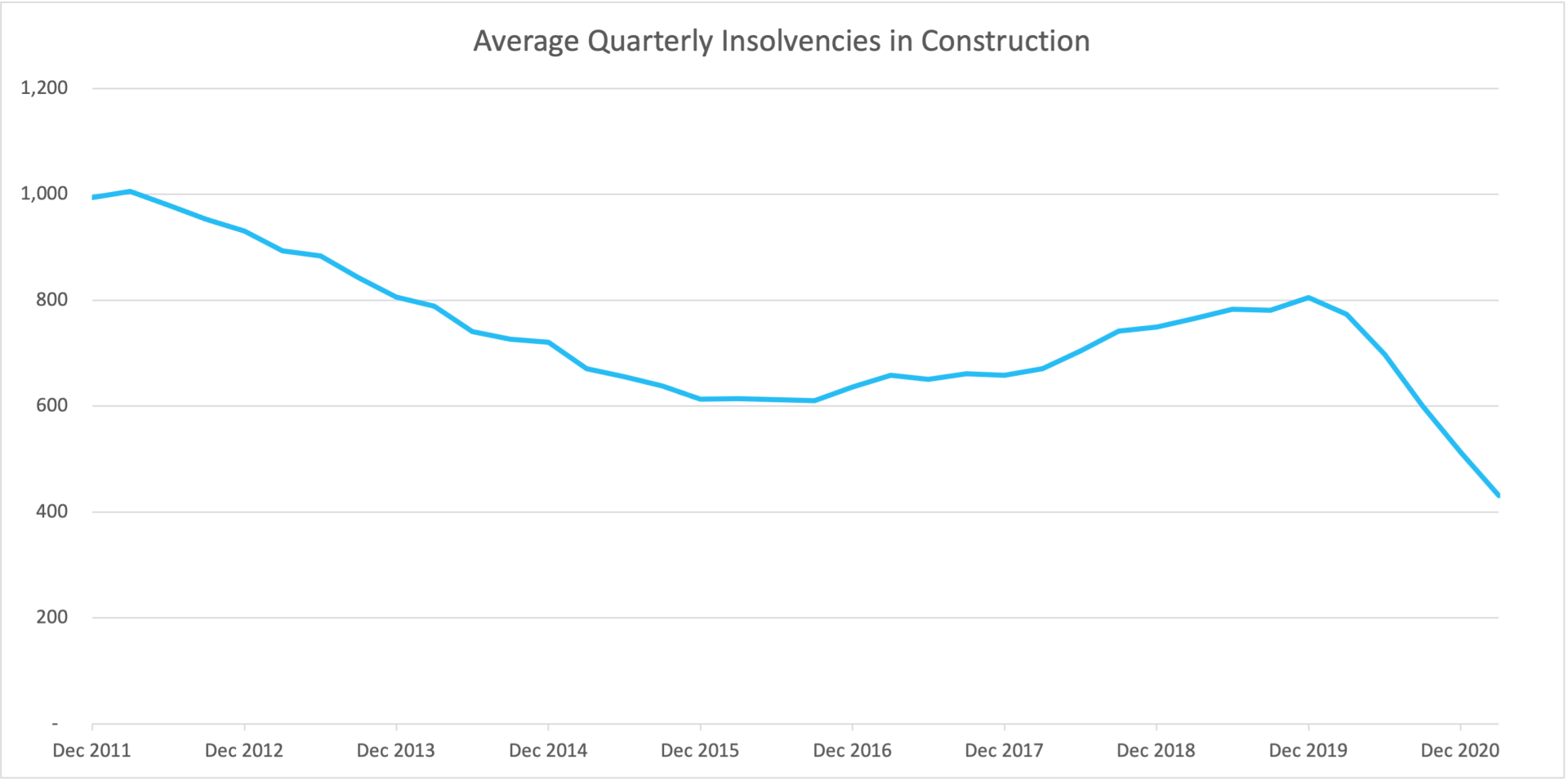

- Company insolvencies in the construction sector are at a 10-year low

It’s a massive worry since these facts are so opposed in normal times. If we assume that insolvencies need to revert to equilibrium, then the journey to get back there is impossible to predict. It could be a slow unwinding, or it could get very messy.

If there is a pent-up tsunami of companies that have sadly got to go bust at some point, how quickly will they go to the wall?

In an industry paralysed by supply chain paranoia at the best of times, anyone with a connection to the sector needs to be aware of what’s going on. We’ll take you through some of the factors that are currently in-play and things to be asking yourself whether you’re in, or exposed to, the sector. You should be aware that we’re seeing a huge amount of risk latent in companies that would have otherwise ceased trading.

What's Happened?

Earlier this month, statistics were released by the UK’s Insolvency Service covering the period to 31st March 2021. These continued to show the trend that all types of insolvency events in the construction sector are continuing to fall. Good news at face value.

And this can broadly be attributed to three things:

1. Government support measures to protect jobs i.e. the CJRS and furlough scheme;

2. Financial support measures provided by lenders supported by the UK Government guarantee; and

3. Legal changes which have temporarily changed the way in which debts are treated between parties e.g. winding-up petitions have mostly been prevented from being presented.

So the COVID interventions made by Government are having the desired effect; huge swathes of businesses are being protected from insolvency. Job done.

But in the same 12-month period to 31st March 2021, over 40% of listed construction and building materials companies announced profits warnings of some sort. And these weren’t just warnings about lower profits. Some high-profile losses include:

• SIG £202m

• Multiplex £158m

• Costain £96m

• McAlpine £27m

• Crest Nicholson £14m

• Keltbray £9m

• Travis Perkins £8m

Now of course, a lot of these losses will be directly related to COVID and we suspect there will also be an element of “kitchen-sinking”. That is COVID has given canny and well-advised CEOs the opportunity to get all their bad news out at once and attribute it to the pandemic, rather than drip-drip-dripping it out. Whether those losses were directly attributable to COVID is debatable, but it’s a common tactic used by companies and politicians when they need an opportune moment to announce bad news which they know they cannot hide forever.

What Happens Next?

The concern for us is that there needs to be a return to “normal” levels of insolvencies somehow. Since the performance of the high profile and top-of-the-supply-chain companies is suffering, it’s the speed and the twang back of the elastic that could cause intense pain.

Like when you take the top predator out of an ecosystem, it can have a disastrous effect on the other plants and animals that inhabit that environment. At best, we could see an entire population of zombie companies (like in the early part of the last decade after the credit crunch) shuffling along on cheap credit.

What This Means For You

At the moment, as lockdown eases we’re seeing the market perform okay. But we have seen evidence to suggest that as firms become more desperate, they are entering into projects at ultra-low margins to secure works. We do hear opinions from the industry that construction will be performing well at the end of 2021/start of 2022, but how reliable that is, is questionable. Residential and infrastructure do seem to be the best places to be currently. And, the better operators in selective trades are doing very well indeed.

A key concern for us currently is labour and materials. Many materials prices are rocketing, particularly metalwork. The cause being a combination of COVID and Brexit. Supply is low and demand high, on which other countries may be having an impact. Steelwork is a particular worry with constant warnings and increases being slapped on by the main suppliers.

Anecdotally, labour costs are rising again as a result of COVID and Brexit. Many overseas temporary workers went back to their home countries and now either can’t, or don’t want to, come back to the UK construction industry. As supply of labour narrows and demand increases, the risk of a temporary worker finishing the day on one site, then going down the road to another site tomorrow for £5/hour more, is becoming more common which is driving up prices.

Construction clients will pass the fixed price risks on to the main contractors, who in turn pass it on to the sub contractors. If they’ve fixed their costs upstream, but not downstream then those subbies are asking for trouble. Especially in the current low profit-margin environment.

Typically in the construction industry you work on a 60:40 split of materials and labour respectively. It obviously varies, but that’s a good rule of thumb. So even a 10% increase in the costs of materials is going to wipe out a 5% profit margin on the project. And if a project is losing labour, then their programme is going to be affected if they don’t increase pay rates.

Main contractors are also finding current conditions difficult. We’ve been acting for one main contractor recently who is bidding on a project with a start date later in 2021. However the steel frame’s not required until late-2023. The main contractor needs to fix costs today for certainty, but the supply chain is simply unable to offer a fixed price for that duration. Most end clients won’t accept a variable price, and there will always be another main contractor who is willing to take a risk and fix costs for the client. So their options are to either (a) put in a high fixed price and risk losing the project to a competitor; or (b) put in a cost closer to spot prices and pray that prices don’t go up. Neither are great places to be in.

There are only limited options in this scenario. The main contractor could try to negotiate a provisional rate, but there aren’t many clients willing to accept this. Another option is to procure the steel once the contract has been awarded. But this is cash-flow intensive and may need to be supported by an Advance Payment Guarantee dependant on risk levels. The storage of the steel would also be costly and needs to be factored into costings (if it’s even possible).

What should you be doing?

In the current market, all industry participants should be making measured and rational decisions based on risk whilst trying to resist the pressures and temptations of keeping revenue high.

Most importantly all construction players need to understand the risks of their decisions and actions. This can be difficult if you’ve become used to operating in a certain way that’s always served you well until now.

Communicating with your supply chain is of vital importance. By exploring the risks and concerns together, you’re likely to be able to reach an agreement that works for all parties, rather than intentionally, or unintentionally, loading one party with a disproportionate amount of risk. Ultimately this approach will result in a project that may not be the cheapest, but does reduce the probability of nasty surprises.

And finally, record-keeping is of utmost importance. Often when disputes are mediated, the party that keeps the best records wins even if they’ve not acted in the proper manner.

What do we think?

There are too many juxtaposed and competing issues in the industry. Something has got to change and we’re getting increasingly concerned by the latent risk we’re seeing build in construction businesses that’s being synthetically prolonged by the COVID support measures.

Whilst the industry continues to be relatively active, it’s likely that many projects will be seen through to completion then Liquidated Damages will be added at the end. Main contractor conduct has regressed and is generally poor at the moment, especially amongst the smaller Tier 1 and Tier 2 players. Payment performance has deteriorated, and many will be turning the screw at the end of contracts.

A lot of these issues will be sent through an adjudication process, which while designed to resolve disputes quickly (<28 days) and cheaply, are often anything but. We’re seeing some very poor quality adjudication outcomes plus the results are private unlike a legal case, so you never know what type of disputes are actually going on.

how can Branta help?

Sometimes it can be difficult to alter your traditional ways of working. But as the route out of the pandemic becomes clearer, so do the risks. By taking external advice to support your commercial decision-making you will benefit from the experience of others whilst maintaining the best of your business. Paying for advice can seem expensive, but it’s nowhere near as expensive as taking poor advice. For an initial free discussion on any issue in construction, speak to one of our experts here construction@branta.co.uk