M&A Valuation Report for February 2022

M&A activity has been on fire in recent years, with more and more businesses becoming interested in selling or acquiring another company. If you're thinking about joining the M&A trend, it's important to understand how to value a business accurately. This report provides an overview of the current M&A market.

If you're looking for some help determining the value of your business, or are curious about what others are paying for similar businesses, these easy-to-read headlines are for you... whether you're ready to sell your business or are just doing your homework.

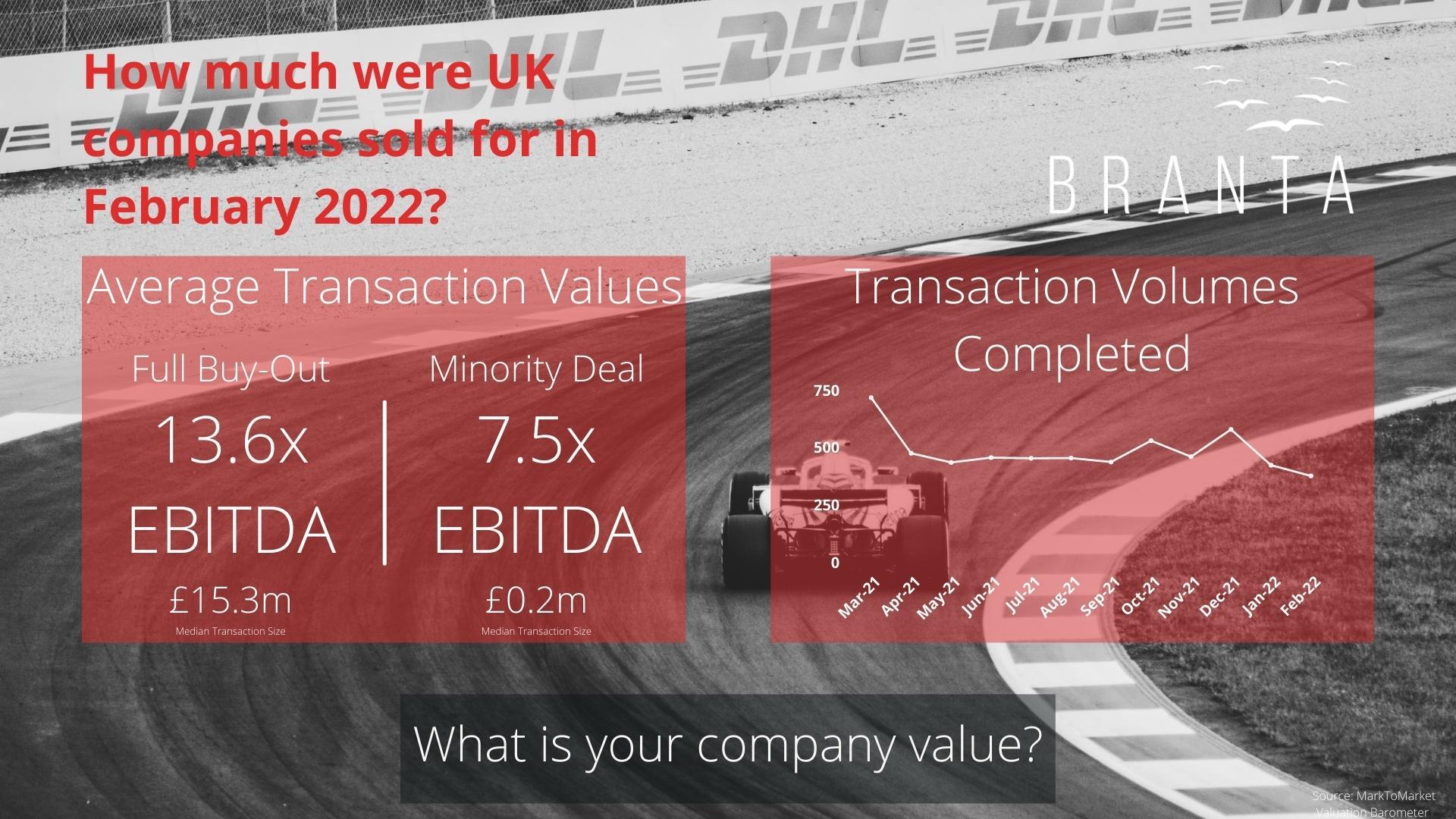

The UK M&A scene appeared to have cooled down a bit following its busy December and January. There were still many noteworthy transactions last month, but deal volumes came off significantly from what they had been just one year ago - when there were almost 500 deals recorded.

But the deal valuations continued to remain high in February 2022 despite the lower volumes.

You can review the key stats by checking out our one-pager below.

So, what does this mean for UK businesses? If you’re looking to sell in the near future, it may be worth doing so sooner rather than later. The market is still healthy and there is demand from buyers, but is there evidence that prices will start to trend downwards as we move further into 2022?

If you're interested in the value or attractiveness of your company, book a free consultation with one of our team here.