M&A Valuation Report for March 2022 | Branta Corporate Finance

Are you curious about how much your business is worth? Wondering what the market is like for small businesses right now? If you're planning to sell in the next year or so, it's important to get a sense of what your business is worth. In this blog post, we share our recent M&A valuation report and give you some insights into what that means for small businesses.

With more and more businesses becoming interested in selling or acquiring another company, it is important to understand how you can value your own business accurately. This report provides an overview of the current market for mergers-and acquisitions (M&As).

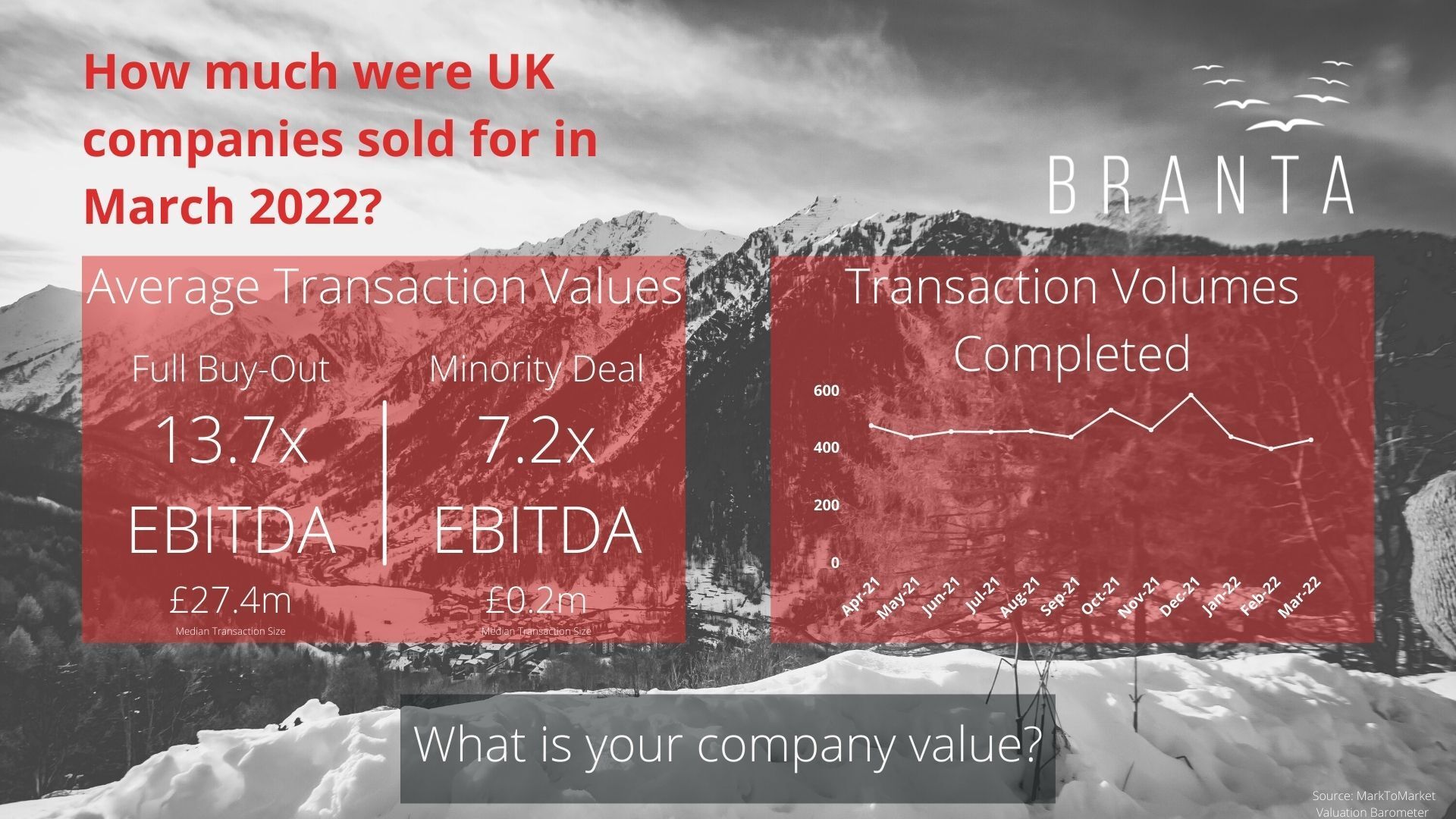

It's estimated by MarkToMarket that total UK deal volumes reached £15.8bn in March 2022. This is up substantially from the £7.1bn announced in the prior month. But it's a far stretch from 12 months ago. This is when predicted changes to the Capital Gains Tax environment never materialised and drove a mass of company sales before the budget deadline.

So, if you’re thinking of selling your business, now may be a good time. Keep in mind that while company valuations have dipped slightly from their peak, they remain high when compared to historic averages. And with many businesses still being sold, there is certainly demand for well-run companies like yours. If you’re interested in learning more about how we can help you capitalise on current market conditions, please don’t hesitate to get in touch. We would be happy to discuss your options and answer any questions you may have.

If you're interested in the value or attractiveness of your company, book a free consultation with one of our team here.